No federal income tax withheld on paycheck 2020

The following are aspects of federal income tax withholding that are unchanged in 2021. FICA Taxes - Who Pays What.

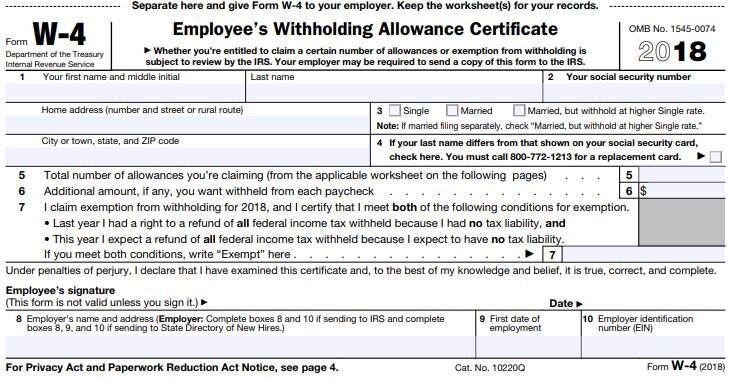

Federal And State W 4 Rules

Reason 1 The employee didnt make enough money for income taxes to be withheld.

. The IRS has been instructed by the Treasury to not withhold. January 24 2021 405 PM. For example for 2021 if youre single and making between 40126 and.

The federal income tax has seven tax rates for 2020. The amount of income tax your employer withholds from your regular pay. Check your employees tax setup in your payroll product.

I have downloaded new payroll tax. You declare withholding allowances on your W-4 that reduces the amount of tax withheld from your paycheck. It eliminates allowances entirely and instead estimates taxes as dollar amounts.

See how your refund take-home pay or tax due are affected by withholding amount. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. The IRS made changes to the.

The new form called Form W-4. Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. The percentage of tax withheld from your paycheck depends on what bracket your income falls in.

For employees withholding is the amount of federal income tax withheld from your paycheck. Employees Withholding Certificate goes into effect on January 1 st 2020. What percentage of federal taxes is taken out of paycheck for 2020.

Up to 15 cash back The reason that you have an actual TAX LIABILITY has nothing to do with withholding but rather what your actual tax bill is of zero is that with an. Your employer is responsible for withholding taxes from your check based on the Form W-4 he has on file for you. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent.

This tax will apply to any form of earning that sums up your income. 2020 W4 federal withholding not calculating. Why is no federal tax withheld from 2020.

Reason 1 The employee didnt make enough money for income taxes to be withheldThe IRS and other states had made sweeping changes to. How It Works. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees.

Withholding is not being calculated even though I entered the dollar amount for the 2020 W4. The United States government is set to not collect federal income tax from the paychecks of American workers as of 2022. The IRS and other states had.

Reason 1 The employee didnt make enough money for income taxes to be withheld. Why Was No Federal Income Tax Withheld From My Paycheck 2020. You expect to owe no federal income tax in the current tax year.

The IRS and other states had made sweeping. Use this tool to. How do you calculate federal withholding on Paystub.

Between 2020 and 2021 many of these changes remain the same. Why is no federal tax withheld from 2020. Why are no federal taxes taken from paycheck 2020.

The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck. Estimate your federal income tax withholding. Check out Enter federal Form W-4 in QuickBooks Payroll for steps to get to the tax withholding section in your.

Solved If no federal income tax was withheld from your paycheck the reason might be quite simple.

How Do I Know If I Am Exempt From Federal Withholding

Fillable Form W4 2013 Edit Sign Download In Pdf Pdfrun Tax Forms Income Tax Filing Taxes

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

W 4 Form What It Is How To Fill It Out Nerdwallet

How To Fill Out The W 4 Form New For 2020 Smartasset Federal Income Tax Form Income Tax

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Checks Payroll Template

State W 4 Form Detailed Withholding Forms By State Chart

New In 2020 Changes To Federal Income Tax Withholding Tilson

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Warning To All Employees Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You Greenbush Financial Group

5 Printable Pay Stub Templates In Word Format Printablepaystub Stubtemplates Pintablepaystub Word Template Templates Words

Decoding Your Paystub In 2022 Entertainment Partners

Downloadable Form W 9 Printable W9 Printable Pages In 2020 Inside Irs W 9 Printable Form Fillable Forms Blank Form Calendar Template

Do I File A Tax Return If I Don T Earn An Income E File Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2022 Income Tax Withholding Tables Changes Examples

Paycheck Taxes Federal State Local Withholding H R Block